Roth Ira Income Limits 2025 Tax. This bonus comes in the form of the saver's credit. Your child's income must be below a certain threshold to contribute to a roth ira.

For taxpayers 50 and older, this limit increases to $8,000. You’re allowed to invest $7,000 (or $8,000 if you’re 50 or older) in 2025.

The IRS announced its Roth IRA limits for 2025 Personal, Your roth ira contribution might be limited based on your filing status and income. Your tax filing status also impacts how much you can contribute.

Roth 401k Annual Limit 2025 Etty Geraldine, 2025 roth ira contribution limits. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

Roth IRA vs 401(k) A Side by Side Comparison, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. To be eligible to contribute the maximum.

The Benefits Of A Backdoor Roth IRA Financial Samurai, If you live in a state with an income tax, you’ll owe tax there too, he added. The income limit to contribute the full amount to a roth ira in 2025 is $146,000, up from $138,000 in 2025.

Roth IRA Rules What You Need to Know in 2019 Roth ira rules, Roth, If you're age 50 and older, you. In 2025, you can contribute a maximum of $7,000 to a roth ira.

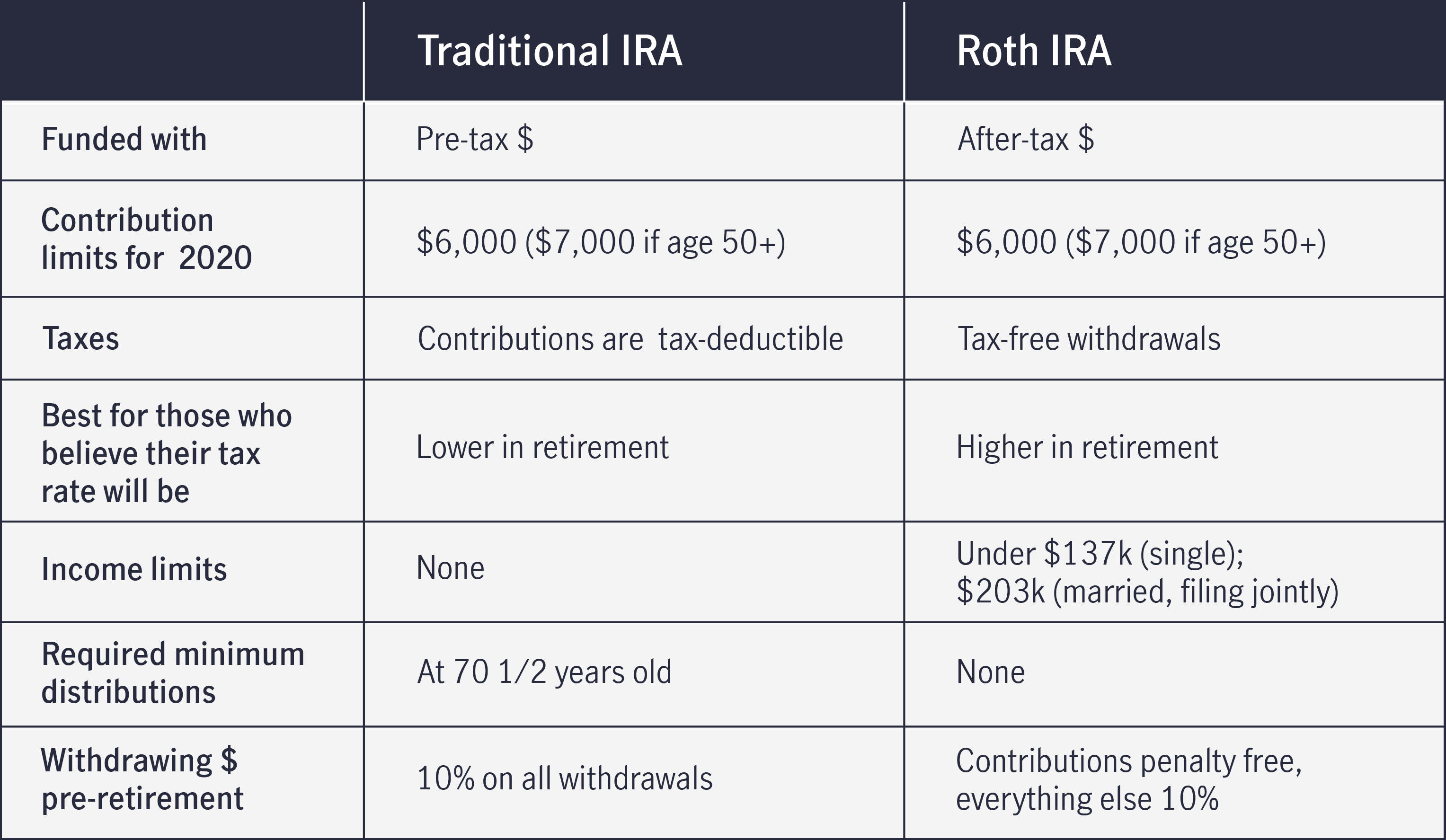

Traditional vs. Roth IRAs What's the Difference? — Fi3 Advisors, The annual roth ira contribution limit in 2025 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. 12 rows the maximum total annual contribution for all your iras combined is:

Annual 401k Contribution 2025 gnni harmony, Your roth ira contribution might be limited based on your filing status and income. The income limit to contribute the full amount to a roth ira in 2025 is $146,000, up from $138,000 in 2025.

The Ultimate Guide To Roth IRA Limits (2025) Michael Ryan Money, The maximum you can contribute to a roth ira in 2025. In 2025, you can contribute a maximum of $7,000 to a roth ira.

Comparing Traditional IRAs vs. ROTH IRAs John Hancock, $8,000 in individual contributions if you’re 50 or older. The income limit to contribute the full amount to a roth ira in 2025 is $146,000, up from $138,000 in 2025.

Roth IRA Limits 2025 YouTube, This is up from the ira contribution limits for 2025,. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.